The Definitive Guide to Pvm Accounting

The Definitive Guide to Pvm Accounting

Blog Article

The 9-Minute Rule for Pvm Accounting

Table of ContentsOur Pvm Accounting IdeasOur Pvm Accounting PDFsPvm Accounting for DummiesThe 4-Minute Rule for Pvm AccountingFacts About Pvm Accounting UncoveredNot known Facts About Pvm AccountingThings about Pvm Accounting

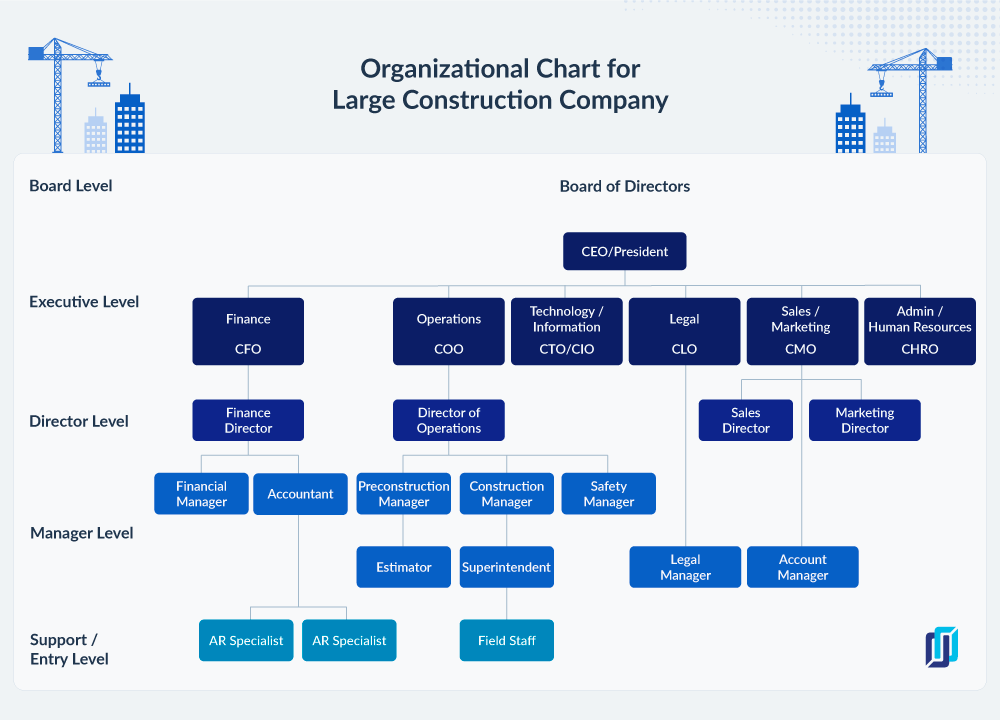

In terms of a business's overall approach, the CFO is accountable for guiding the firm to satisfy economic objectives. Some of these techniques can involve the company being gotten or acquisitions going forward.

As a service expands, accountants can liberate a lot more staff for other service responsibilities. This can eventually bring about enhanced oversight, greater precision, and much better compliance. With more sources adhering to the trail of money, a specialist is far more likely to obtain paid properly and promptly. As a building and construction company expands, it will certainly require the help of a full time monetary team that's managed by a controller or a CFO to take care of the business's funds.

A Biased View of Pvm Accounting

While huge services might have full time monetary assistance teams, small-to-mid-sized organizations can hire part-time bookkeepers, accounting professionals, or financial consultants as required. Was this short article useful?

Effective bookkeeping techniques can make a considerable difference in the success and growth of building and construction firms. By implementing these practices, building services can enhance their monetary stability, streamline operations, and make notified choices.

Comprehensive quotes and budget plans are the backbone of building job management. They aid steer the task in the direction of prompt and lucrative completion while securing the interests of all stakeholders entailed. The vital inputs for task expense evaluation and budget plan are labor, materials, devices, and overhead costs. This is usually among the most significant expenditures in building and construction projects.

The 9-Second Trick For Pvm Accounting

A precise evaluation of products required for a task will certainly help ensure the necessary products are purchased in a timely manner and in the appropriate amount. An error below can bring about wastefulness or hold-ups as a result of material lack. For the majority of building projects, equipment is needed, whether it is acquired or leased.

Don't neglect to account for overhead expenditures when approximating task costs. Direct overhead costs are certain to a job and might consist of short-lived services, energies, fencing, and water materials.

Another aspect that plays right into whether a job achieves success is an accurate estimate of when the project will certainly be finished and the related timeline. This price quote aids make certain that a job can be completed within the alloted time and resources. Without it, a project may lack funds prior to conclusion, triggering potential job standstills or abandonment.

Pvm Accounting Can Be Fun For Anyone

Exact job costing can assist you do the following: Understand the success (or lack thereof) of each task. As task costing breaks down each input into a job, you can track earnings independently.

By determining these products while the job is being finished, you avoid surprises at the end of the project and can address (and with any luck prevent) them in future jobs. An additional device to aid track jobs is a work-in-progress (WIP) schedule. A WIP routine can be completed monthly, quarterly, semi-annually, or annually, and consists of task data such as contract worth, sets you back incurred to date, total approximated expenses, and total job payments.

The Ultimate Guide To Pvm Accounting

Budgeting and Projecting Devices Advanced software offers budgeting and forecasting capacities, permitting building firms to prepare future jobs extra precisely and handle their funds proactively. Record Monitoring Building and construction projects entail a lot of documentation.

Boosted Vendor and Subcontractor Monitoring The software can track and handle repayments to vendors and subcontractors, ensuring prompt repayments and keeping excellent relationships. Tax Obligation Preparation and Filing Accounting software can aid in tax obligation preparation and declaring, making sure that all appropriate monetary activities are precisely reported and tax obligations are filed on schedule.

Rumored Buzz on Pvm Accounting

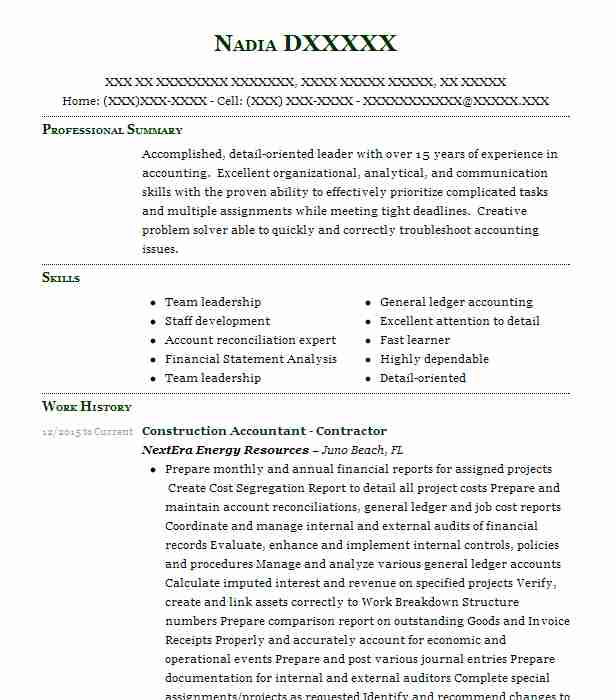

Our customer is an expanding advancement and construction firm with headquarters in Denver, Colorado. With numerous energetic building and construction tasks in Colorado, we are searching for an Accountancy Assistant to join our team. We are looking for a permanent Accounting Aide that will certainly be in charge of giving useful assistance to the Controller.

Obtain and assess day-to-day billings, subcontracts, modification orders, purchase orders, check requests, and/or other related documents for efficiency and conformity with economic policies, treatments, budget, and legal requirements. Update regular monthly analysis and prepares budget plan trend records for building and financial reports construction tasks.

Some Known Factual Statements About Pvm Accounting

In this guide, we'll explore different facets of building accountancy, its significance, the standard tools utilized in this location, and its role in building and construction jobs - https://pvm-accounting-46243110.hubspotpagebuilder.com/blog/building-financial-success-with-construction-accounting. From economic control and expense estimating to cash money circulation management, discover exactly how audit can profit building and construction jobs of all ranges. Building and construction accounting refers to the specific system and procedures used to track financial details and make strategic choices for building and construction organizations

Report this page